Overview

The Kuali budget engine in Proposal Development is a powerful tool that allows users to create proposal budgets using the institutional rates for fringe, F&A, inflation, etc. along with the appropriate object codes for Personnel and Non-Personnel line items. The budget engine will use the configured rates to automatically calculate your budget and do it on a precise daily calculation - along with auto-calculating associated cost share and unrecovered F&A if applicable. Below gives more explanation on how the budget engine calculation works with examples to give a better understanding of the functionality. If ever you have questions on budget calculation or configuration don't hesitate to reach out to us.

Requested Salary

Kuali Budget calculates the Requested Salary on a Personnel Line item as a percentage of the value listed in the Base Salary field on the Project Personnel page. When an individual is added as a line item in the Assign Personnel to Periods page the budget calculates the salary down to the day, and percentage listed.

Important Values for Budget Calculation:

- Appointment Type

- Base Salary

- Charged Effort

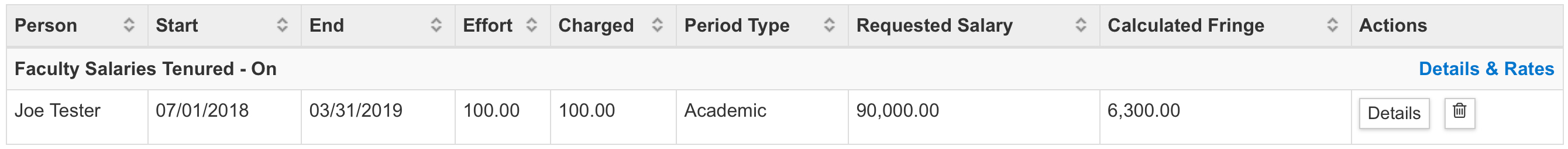

A person with a $90,000 and a 9 month appointment will receive their full salary if they are listed in the budget for 9 months (Example From July 1 2018 - March 31st 2019), so in this case their monthly salary is $10,000.

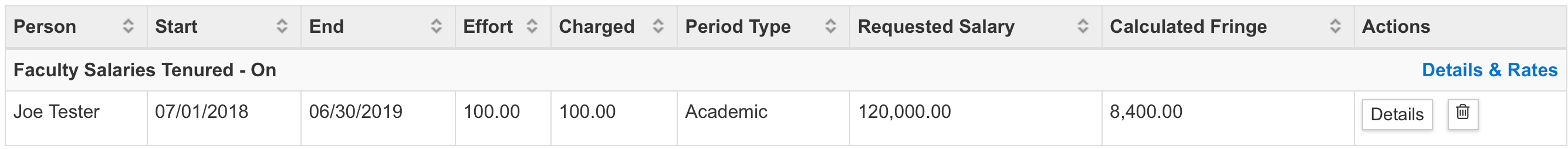

If they were budgeted for 12 months at 100% they would receive $120,000, which represents the work performed beyond their normal appointment period.

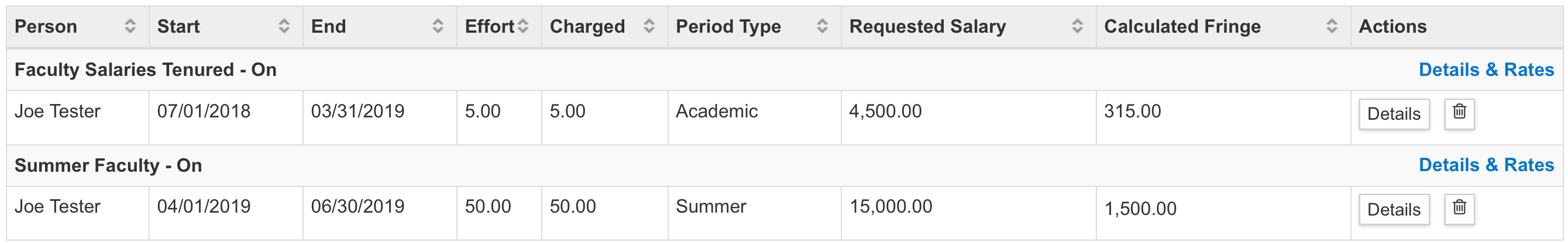

This appointment dynamic is how summer salary can be included on a budget. In a budget where a faculty member has a summery salary they would be budgeted for all the months in a given period that overlap the school year with a faculty object code. These line items will generally add up to 100% of their appointed salary, and they would receive their full salary and fringe benefit amounts for these line items. Then an additional line item would be added for the extra summer months with a summary salary object code. This line item will provide additional salary beyond their normal appointment, but with the lower fringe rate associated with summer salary.

The final requested salary value is gained by multiplying the total salary the person would earn for the period they are budgeted and multiplying it by the Charged Effort listed in the line item.

Example: Joe Tester makes $90,000 in a 9 month appointment. He is listed for 9 months on her proposal budget at 5% effort. The total requested salary for this line item is $4500. He is also listed for 3 months of summer salary at 50% effort. The requested salary on this line item is 15,000.00.

The above calculation does not include any inflation. See how inflation impacts this calculation below.

Calculated Fringe

Fringe rates are defined by the object codes in the budget. The object code for 'Faculty Tenured - On Campus' will likely have a different Fringe rate than the object code for 'Summer Faculty - On'. When you add line items in a given personnel object code you can click on the Details & Rates link, and then click on the Rates tab to see which Fringe rates are being applied to your line items.

Example: With the same scenario as above, Joe Tester's University has a Faculty Tenured fringe benefit rate of 7%, and a Summer Salary fringe benefit rate of 10%. So on his budget he has $315 in fringes included for his academic year line item and $1500 in fringes included for his summer line item.

Inflation

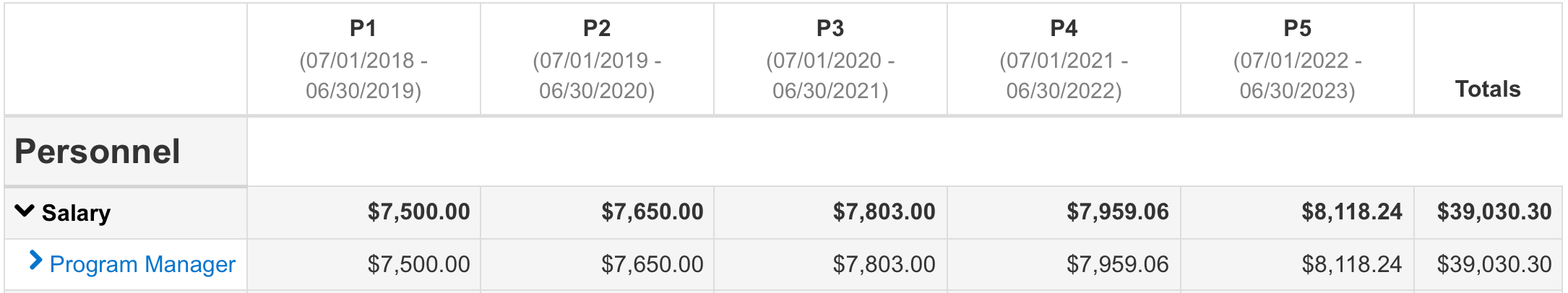

For Personnel object codes the inflation rate is applied starting on the first date of each new fiscal year by default (7/1). So if your periods line up perfectly with the fiscal year then inflation will be applied cleanly across your periods. The below examples will have a calendar budget line to keep it straightforward to understand.

Example: The proposal Joe Tester is submitting has a period of 7/1/2018-6/30/2023. His institution's fiscal year begins on July 1st, and they have an institution inflation rate of 2%. There's a TBN Project Director's calendar salary line with 10% effort on $75,000 base salary for a requested salary of $7,500 in Period 1. In Period 2 with the 2% inflation rate applied on 7/1 it goes to $7,650 for the requested salary - future periods then apply the inflation rate again.

However, if your periods do not line up perfectly with your institution's academic year then inflation will be applied in the middle of a period, and the calculation becomes more complicated. It also depends on what dates your specific budget lines have been set up under since the inflation will apply on any portion after the 7/1 fiscal year date.

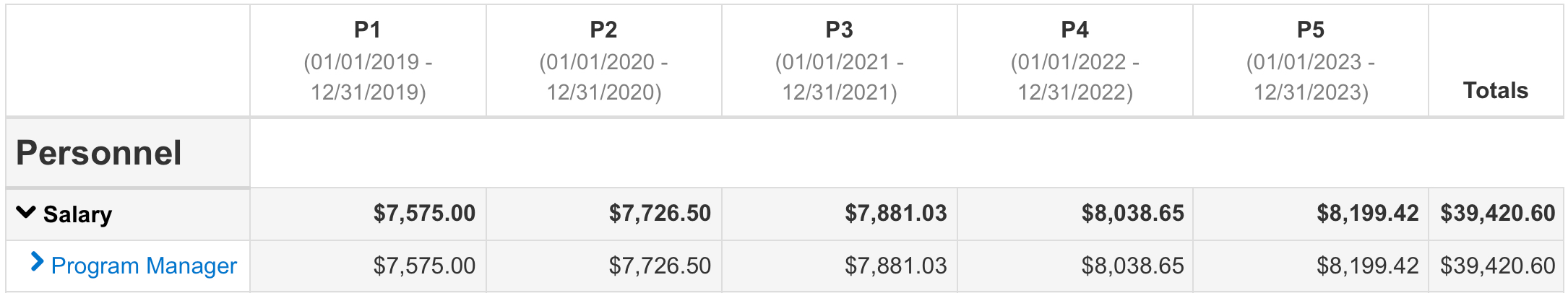

Example: The proposal Joe Tester is submitting has a period of 1/1/2019-12/31/2023. His institution's fiscal year begins on July 1st, and they have an institution inflation rate of 2%. So the TBN Project Director's calendar salary line in Period 1 is $7,575 since half of the inflation rate was applied even to the first period. Future period inflation will also be applied in the middle of the period, but it is easier to calculate, because each period will go up by 2% overall. So Joe Tester's period 2 calendar line item will be $7.726.50 - future periods then apply the inflation rate again.

NOTE: If you have line items with specific date ranges (i.e. Academic or Summer) the inflation rate will be applied accordingly and only apply the inflation for the portion after 7/1.

Vacation Rates

Vacation rates are defined by the object codes in the budget. The object code for 'Staff Exempt - On Campus' will likely have a different Vacation rate than the object code for 'Staff Non Exempt - On Campus'. When you add line items in a given personnel object code you can click on the Details & Rates link, and then click on the Rates tab to see which Fringe rates are being applied to your line items. The calculations are applied identically to Fringe rates, and the behavior will match the Fringe Example.

Other Rates and Calculated Direct Costs

Other rates can be applied to any object code in the budget. There are instances where a university might apply a calculated direct cost to a non personnel line item. These rates work exactly like Fringe and Vacation rates, but are applied to non personnel line items. As an example the university might apply an installation fee for a specific class of Equipment due to a labor contract they have. They could apply a 10% Service Support Installation rate to a specific class of Equipment. When that object code is used that 10% amount would be applied to the Calculated Direct Costs section of the budget.

Example: Joe Tester has included a wind tunnel in the first year of her budget for $10,000. Since this equipment will need to be installed by the university's service and support staff the negotiated installation rate of 10% is applied to the equipment line item automatically and $1000 is added to calculated direct costs.

F&A

F&A costs are calculated based on the F&A rate listed in the F&A Rate Type field of the Budget Settings screen. Each rate is linked to the object codes that should be included in that F&A Base type. If an object code is linked to the rate type of your budget the F&A rate will be applied to that object code. If any object codes in your budget are not linked to your F&A rate type, then they will not have any F&A applied to their base cost.

Example 1: Joe Tester is applying to an NSF grant, and his institution's negotiated MTDC F&A rate is 50%. She checks his rate calculations when he is finished with the entries described in the above examples to make sure his F&A is mapped and calculating properly.

- Academic Salary: $4500 Direct / $2250 F&A

- Academic Fringe: $315 Direct / $157.50 F&A

- Summer Salary: $15,000 Direct / $7500 F&A

- Summer Fringe: $1500 Direct / $750 F&A

- Equipment: $10,000 Direct / $0 F&A

- Calculated Equipment Installation: $1,000 / $0 F&A

F&A total: $10,657.50

Example 2: Joe Tester hears back from his Program office that his proposal was not accepted, but he has learned about a new opportunity from a foundation that funds research in his state, and they have an opportunity open that his research is a good fit for. So he copies his proposal and adjusts it for this new opportunity. Unlike the NSF this foundation pays indirects on Total Direct Costs, but only pays 10% overhead. After making the appropriate adjustments to his copied budget his indirects now come out to the totals below.

- Academic Salary: $4500 Direct / $450 F&A

- Academic Fringe: $315 Direct / $31.50 F&A

- Summer Salary: $15,000 Direct / $1500 F&A

- Summer Fringe: $1500 Direct / $150 F&A

- Equipment: $10,000 Direct / $1000 F&A

- Calculated Equipment Installation: $1,000 / $100 F&A

F&A total: $3,231.50

Note: The default behavior is to have all Indirect Rates apply to Fringe the same way they apply to salaries. If your school is using the SF424 short form and does not apply their negotiated S&W rate to Fringes this behavior can be modified through the administrative screens.

Cost Share

Cost Share for Non-Personnel Line items is manually entered by the user on the Cost Sharing tab of the Details screen for individual Non-Personnel entries.

Cost Share for Personnel Line items is the difference between the costs calculated on the 'Charged' % and what would be calculated on the 'Effort' % listed for a given person. This difference includes the Requested Salary, Fringe, Vacation, and F&A costs associated with the cost shared effort.

Example: The Foundation that Joe Tester is submitting the revised version of her grant to requires cost share, so he is now claiming some effort he was planning to put into the grant, but that his school did not want him to include on the federal version of the grant, but the NSF opportunity did not require cost share. While he is still only charging 5% effort to the grant during the school year, he is going to spend 10% of his effort on the project during this time period. The breakdown of this calculation is shown below.

- Academic Salary: $4500

- Academic Fringe: $315

- Total F&A: $481.50

Since the amount being charged, and the amount being cost shared are the same the cost share for this effort is $5296.50.

Unrecovered F&A

Unrecovered F&A is a measure of the difference between the F&A that would have been collected on a budget if normal F&A was used, and the F&A collected in a non standard budget. There are several different configurations in a budget that can prompt Unrecovered F&A.

Adjusting the Rate without changing the rate type: In this scenario the user uses the standard rate type, but in the Rates page of the Budget they lower the rate being used. This is the most common, and simplest form of Unrecovered F&A. The simplest example of this is on a TDC budget at an institution with a normalized TDC rate of 10% the user modifies the rate to be 6%. On a $10,000 budget the normal F&A would have been $1000, but due to the change it is only $600. So the Unrecovered F&A is $400, which is the difference between these two number.

Exempting a Line Item from the F&A base: In this scenario the user goes into the Rates tab of the Details on a line item that would otherwise be included in the F&A base. The amount of F&A on that item is moved from the F&A to Unrecovered F&A.

Example: Joe Tester is working on his Foundation submission and realizes he needs some more cost share on his proposal to meet the cost share match requirement. This particular foundation allows you to cost share unrecovered F&A, based on the F&A they pay. So he goes into the line item for her Wind Tunnel and on the Rates tab unchecks the line for TDC F&A. This moves $1000 out of the calculated F&A for the proposal, and adds it to the Unrecovered F&A for the proposal. He then adds $1000 to the cost share for the Wind Tunnel so the amount is reported to the agency.

Listing a different F&A Rate Type and Unrecovered F&A Rate Type: In a situation where you're institution's default rate type is different from the rate type of a given proposal you will enter a different rate type for Unrecovered F&A Rate Type and F&A Rate Type on the Budget Settings screen. In this situation the system will list the difference between the total F&A being charged on your budget and what would have been charged on the Unrecovered F&A Rate Type as your Unrecovered F&A total.

Example: In the F&A example above the MTDC F&A that Joe Tester listed on her NSF proposal was $11,250, but the TDC F&A that was listed on his Foundation proposal was $3,360. These two values were calculated on different based that included different line items though. To get the system to properly calculate his comparison he lists TDC as her F&A Rate Type and MTDC as his Unrecovered F&A Rate Type, and adjusts the TDC rate in the Rates page to 10% for each year of her proposal. The value the system lists for her Unrecovered F&A based on the line items listed above is $7,890.

A Detailed Example for Personnel Cost Calculation

Kuali Proposal Budget calculates by months and days and as an example let's budget a Post-Doc to demo the calculation (this methodology can be applied to other personnel also):

Let's consider TBA, PostDoc (with Job Code 01) - For the Requested Salary Calculation, Kuali is looking at:

- The Base Salary of $44,000, effective as of 07/01/2014 (12 M salary)

- In the Rates section, the Inflation for Postdoctoral Staff is 3% and takes place every 7/1 after the salary effective date indicated (so 7/1/15, 7/1/16 the base salary will inflate by 3%)

So, in the Assign Personnel to Periods section, it indicates that the PostDoc is going to contribute 100% effort during the period of 09/30/2015 - 08/29/2016. To calculate the Requested Salary Kuali is doing the following with the Base Salary:- For Period: 09/30/2015 - 06/30/2016 (9 Months and 1 day in September): Kuali uses Base Salary of 45,320 (44,000 x 1.03); Monthly = 3,776.67

- For Period: 07/01/2016 - 08/29/3016 (1 Month and 29 days in August): Kuali uses Base Salary of 46,679.60 (45,320 x 1.03); Monthly = 3,889.97

Taking this into considerations, here is the 'formula' Kuali is using for Requested Salary:

[(3,776.67 x 9 months x 100% effort) + (3,776.67/30 days x 1 day x 100% effort] + [(3,889.97 x 1 month x 100% effort) + (3,889.97/31 days x 29 days x 100% ] = 34,115.89 + 7,528.97 = 41,644.86 (which is what we see in Kuali)

For the Fringe Benefits, it takes the Requested Salary and multiplies it times the Employee Benefits - Research Rate (On Campus) of 26%:

41,644.86 x 26% = 10,827.66

And then for the Vacation calculation, it also takes the Requested Salary but this time it multiplies it times the Vacation Rate (On Campus) of 10%:

41,644.86 x 10% = 4,164.49

The above methodology would be applied for all budget periods and any configured inflation as explained above would also be applied to the calculation if included.

Comments

0 comments

Article is closed for comments.