Overview

Over the life of a Kuali Research implementation, schools often find they need to add granularity to their budget object code options. This may be because of revised financial budgeting requirements from their institution, or the need to map expenses to a wider variety of budget sections in their S2S applications. The process for adding an Object code involves adding the code and then mapping it to all appropriate rates so the calculations detailed in the Proposal Budget - Budget Engine Calculations function as expected.

Add a New Object Code

Many institutions setup object codes to match expense codes in their financial system. If your institution follows this procedure make note of the appropriate value for your new Object Code. If your Kuali Research object codes are managed independently from your financial system then search for the next available code in the Object Code table and make note of it.

System Process

Navigate to All Links on the Dashboard and search for Object Code and select.

Click the create new button in the upper right-hand corner of the screen and complete the following fields on the Cost Element Maintenance Document that displays.

- Description (Document Overview): Enter a description per your institution's naming standards.

- Object Code Name: Enter the appropriate code from your financial system, or the next available code noted above.

- Budget Category Code: Perform a lookup using the magnifying glass icon next to this field. Search for and return the appropriate budget category for this object code. You can reference the Budget Category Maps and Budget Category Mapping tables to see how the various budget categories map to S2S budget outputs.

- Description (Edit Cost Element): The name that will display for this object code in the budget module.

- Unit Number: For a single campus implementation list the top unit of your unit hierarchy. If this object code should only be available to specific branches of your unit hierarchy, which is commonly used in multi campus implementations, list the highest unit that should have access to this object code.

- On/Off CampusContract Flag: If this value is unchecked then this object code will default to being Off Campus when added to a budget. If this value is checked then this object code will default to being On Campus when added to a budget.

- Active: Check this box for a new object code. If an object code is retired and should no longer be used on new budgets, but needs to be retained for historic budgets then the object code can be edited to remove the Active flag.

Once you have completed the above fields, press the submit button at the bottom of the screen.

Mapping Your Object Code to Rates

At this point in the process your Object Code is available in the budget module, but if it is included in a budget no rate calculations will execute. To setup budget calculations based on your object code you need to map it to all appropriate rate types. The rate types each drive different calculations in the budget as described below. To see an example of how these rate mappings play out in a sample budget scenario please review the Proposal Budget - Budget Engine Calculations article.

F&A Rate Types: When you map an F&A rate type to an object code, then these expenses will be included in the F&A base amount on any budgets that match the mapped F&A rate type

Example: A budget has two line items. 1 Faculty Emeritus Salary line item for $5000, and 1 Equipment>$5k line item for $8000. The Faculty Salary object code is Mapped to the MTDC and TDC rate types. The Equipment line item is only mapped to the TDC rate type since Equipment is not included in MTDC calculations.

On a TDC budget, the F&A Base amount is $13,000 since both line items are included.

On an MTDC budget, the F&A Base amount is $5000 since the Faculty Salary object code is mapped to MTDC, but the Equipment>$5k is not mapped to MTDC.

Employee Benefit and Vacation Rate Types: When you map a personnel object code to a Fringe Benefit or Vacation rate whenever a line item is used with this object code the rates associated with the Fringe and Vacation types will be automatically calculated and added to the budget as fringe.

Example: On the budget above the Personnel line item is changed to Faculty Tenured. This object code is mapped to a 25% Employee Benefit rate, and a 10.5% vacation rate. So the total fringe rate on this individual is 35.5% The Fringe amount calculated for this object code is $1,775.

Inflation Rate Types: When future budget periods are generated based on Period 1 in the Proposal Budget module, the inflation rate for each object code will be added to line items on each year after the first. This increase is cumulative. For personnel object codes the inflation rate will be applied on the anniversary of the salary effective date. On non-personnel object codes, the inflation rate will be applied at the beginning of each period.

Example: On the budget above, the Faculty Emeritus object code is mapped to the Research Staff inflation rate, which is 3%. The equipment is linked to the Materials and Services inflation rate which is 2%. This is a 5 year budget that begins on the first day of the fiscal year, so when the periods are all calculated the totals are as follows

- Period 1

- Faculty Emeritus: $5000

- Equipment>$5K $8000

- Period 2

- Faculty Emeritus: $5150

- Equipment>$5K $8160

- Period 3

- Faculty Emeritus: $5204.50

- Equipment>$5K $8323.20

- Period 4

- Faculty Emeritus: $5463.64

- Equipment>$5K $8489.66

- Period 5

- Faculty Emeritus: $5627.54

- Equipment>$5K $8659.46

Personnel Object Codes are generally mapped to a rate in the following classes as appropriate for your institution:

- MTDC (Rate Class 1, F&A Type)

- TDC (Rate Class 2, F&A Type)

- S&W (Rate Class 3, F&A Type)

- Employee Benefits (Rate Class 5, Fringe Benefits Type)

- Inflation (Rate Class 7, Inflation Type)

- Vacation (Rate Class 8, Vacation Type)

- AWARD Rates (Rate Class 13, F&A Type)

Non-Personnel Object Codes may be mapped to a rate in the following classes as appropriate for your institution and the expense type represented by the object code:

- MTDC (Rate Class 1, F&A Type)

- TDC (Rate Class 2, F&A Type)

- Inflation (Rate Class 7, Inflation Type)

- AWARD Rates (Rate Class 13, F&A Type)

Note: There are other rate classes that may be necessary if your institution tracks Lab Allocation or other custom rates. If you make use of rate classes beyond the ones listed above please reference your institutional documentation for appropriate mappings.

System Process

Navigate to All Links on the Dashboard and search for Valid Cost Element Rate Type and select.

Complete the following steps for each rate that needs to be Mapped to your Object Code

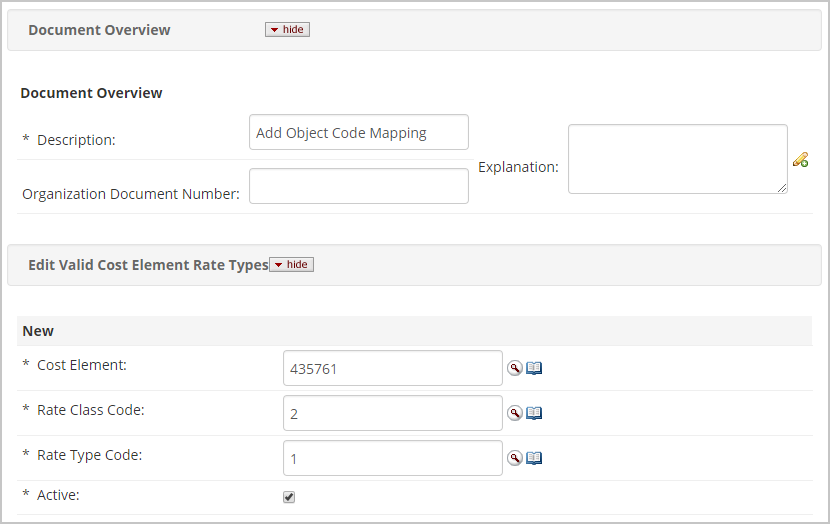

Click the create new button in the upper right-hand corner of the screen and complete the following fields on the Valid Cost Element Rate Types Maintenance Document that displays.

- Description: Enter a description per your institution's naming standards.

- Cost Element: The Object Code you setup in the step above.

- Rate Class Code: The Rate Class code of the rate you are mapping. This can be returned via a lookup using the magnifying glass icon next to the field.

- Rate Type Code: The Rate Type code of the rate you are mapping. This can be returned via a lookup using the magnifying glass icon next to the field. If you have already selected your Rate Class that will be used to filter down search results.

- Active: Check this box for a new object code rate mapping. If an object code is retired and should no longer be used on new budgets, but needs to be retained for historic budgets then the rate mapping can be edited to remove the Active flag.

Once you have completed the above fields press the submit button at the bottom of the screen.

Comments

0 comments

Article is closed for comments.